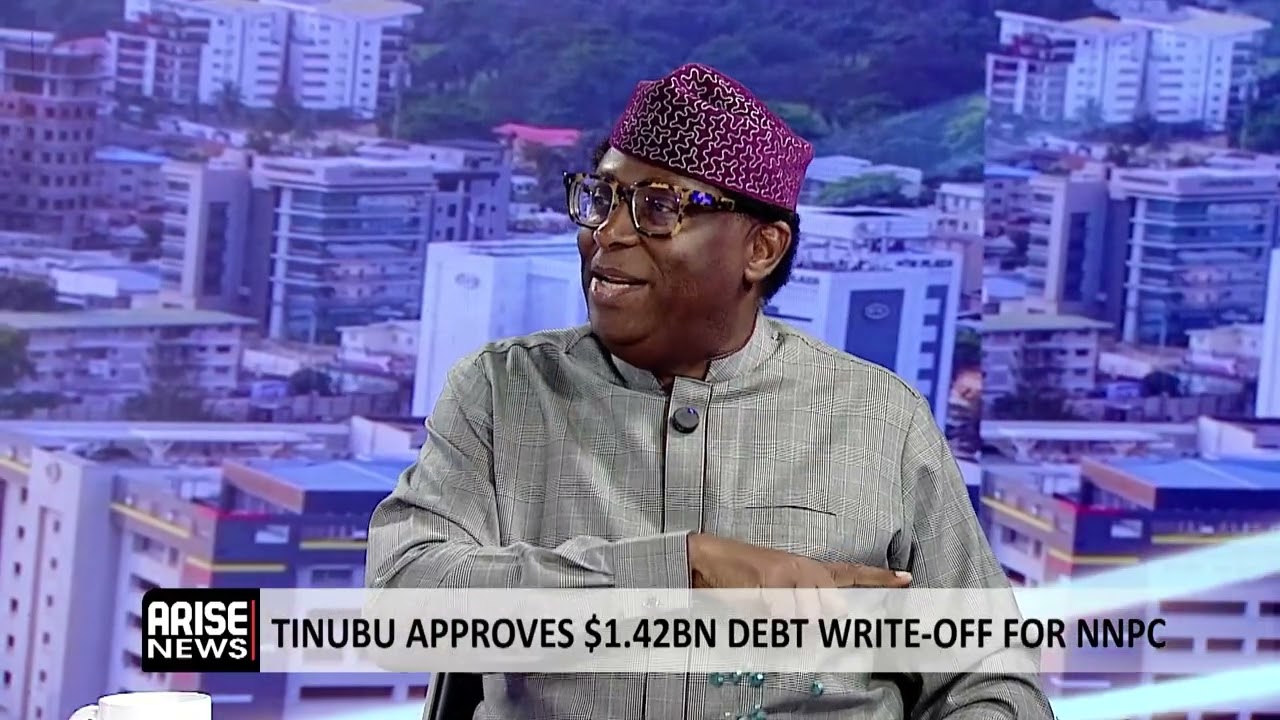

Chief Executive Officer of the CFG Advisory, Tilewa Adebajo has stated that Nigeria’s handling of the recently announced NNPC debt write-offs has reignited concerns about governance, transparency, and fiscal sustainability, warning that the process reflects deeper structural weaknesses in the country’s economic management.

In an interview with ARISE NEWS on Wednesday Adebajo said the controversy surrounding the write-offs underscores a persistent trust deficit between the government and the public, driven largely by poor communication and unclear adherence to due process.

“The bane of this government is the fact that they have not been able to sustain their economic narrative.”

He acknowledged that recent statements by the Minister of Finance and Coordinating Minister of the Economy attempted to clarify Nigeria’s economic direction. “The Minister of Finance and the Coordinating Minister of the Economy sent out a powerful statement over the weekend, just before the markets opened on Monday, which I think was one of the best statements I’ve seen, in terms of giving us an overall idea as to what is happening, but unfortunately this statement about these debt write-offs, on a unilateral basis, is a cause for concern.”

According to Adebajo, while the president has the authority to initiate policy, writing off liabilities of such magnitude must follow established legal and institutional channels. “I think we should establish that the president can initiate and endorse policy, but if he’s going to do something like this write-off, by law it has to go through the finance minister, through the FAC for ratification, and the National Assembly also has a role to play.”

He explained that any adjustment affecting NNPC’s obligations has implications for the federation account, which constitutionally belongs to the federal, state, and local governments. “There’s definitely a federation account issue here that we need to discuss, because if you take a look at Section 162, you also see that the National Assembly has a role to play, and this has to go through the finance minister and the FAC, involving the states.

Within the Petroleum Industry Act, the new one, there are legacy obligations that need to be resolved, and there’s also a resolution mechanism for that, which is done through the PIA Transition Liability Allocation Instruments and corporate shareholder governance for NNPC.”

Adebajo questioned whether the debt write-off was executed through these channels or appeared. “So what is important for us is that we need to understand what the president was doing was it through the liability reconciliation mechanism or was it through the FAC because even if he did that through the liability resolution mechanism, it still has to go through the FAC process and the National Assembly for ratification.”

He said the company struggles to meet current liabilities and remains burdened by receivables and debts that have yet to be fully reconciled. “Even if you take a look at the basics of the account after I review it, NNPC cannot even meet its current liabilities, it exceeds its current assets. So that means it’s liquid if you take a look at just the headlines, not to talk about when you drill down to the numbers and look at the receivables and all these debts that they’re talking about, which is good because there’s a lot of reconciliation. And what a lot of people are not talking about really is the fact that there’s still $42 billion that has been unaccounted for. That’s a hell of a lot of money.”

He dismissed claims that reconciliation alone explains the situation, insisting that any organisation doing business on behalf of the government must maintain clear records of payments, subsidies, and remittances to the federation account. “You can’t say that because you are doing business with government, you don’t reconcile. If government tells you to pay for something, there must be an account of what you’ve paid for in terms of the subsidies that you’ve been doing over the years. The Central Bank did it borrow a leaf from the Central Bank’s book. When we had all those backlog of effects, they got a forensic auditor, Deloitte came in, reconciled all those things. And the ones that were genuine, they paid, the ones that were not genuine, they discarded them. And we don’t have that problem today. So NNPC also needs to do a forensic audit.”

Adebajo was particularly critical of NNPC’s governance structure, questioning whether its board is functioning effectively. “Those that were attacking you the other day when you were saying NNPC is as good as not having a board, does this look like the NNPC has a board that is a working structure? This governance structure is dead.”

He extended his criticism to Nigeria’s broader fiscal position, warning that the government continues to operate budgets that are not realistically fundable. “The problem of Nigeria is fiscal. This tax thing they’re following, the tax reforms, are not going to make an impact on the growth of the economy. The problem of Nigeria now is that there is a lack we do not see the disinflation and growth strategy that will generate productivity and create employment. That is what this government is lacking.”

Adebajo said Nigeria needs to focus on policies that expand productive capacity, stimulate investment, and create employment, rather than relying on headline indicators such as foreign reserves. “Your reserves are just telling you that you have import cover for nine or ten years. It’s not your reserves, it’s not your reforms that will grow your economy. It’s your policies.”

Looking ahead to 2026, he expressed scepticism about optimistic growth projections, describing four percent growth as inadequate for a country with Nigeria’s population size. “Four percent economic growth for Nigeria’s population of 200 million is grossly inadequate. The clear and present danger today in Nigeria is the fiscal side of the equation. We have a deficit financing of 24 trillion naira in the 2026 budget. It is unclear how we’re going to fund that deficit. Cumulative deficit over the last three years is close to 50 trillion naira. Excess crude account now is less than $100,000. In 2019, our excess crude account was $25 billion. Now we do not have any buffers. The sovereign wealth fund that is supposed to manage a stabilisation fund for fiscal issues has less than $100 million. That can’t do anything. So we have significant fiscal challenges.”

Adebajo concluded that while recent reforms may be necessary, Nigerians are unlikely to feel their benefits without clearer communication, stronger governance, and deliberate coordination of fiscal, monetary, industrial, and trade policies. “I have my doubts. The doubts I have is not because the reforms have not been done, but in terms of communication and seeing a plan. We need a disinflation and growth strategy plan. We need to see projects in all sectors of the economy that we know can grow the economy, that can transform. So it’s a question of coordination. We need not only coordination of monetary policy with fiscal policy, but also with trade policy, investment policy, and industrial policy. Everybody’s working in silos, but we need to see that coordination.”

Erizia Rubyjeana

Follow us on: